ブログ総もくじ 伏見啓明整形外科公式サイト Coロナ関連記事目次 今、電子カルテがあぶない 個人情報談義 目次

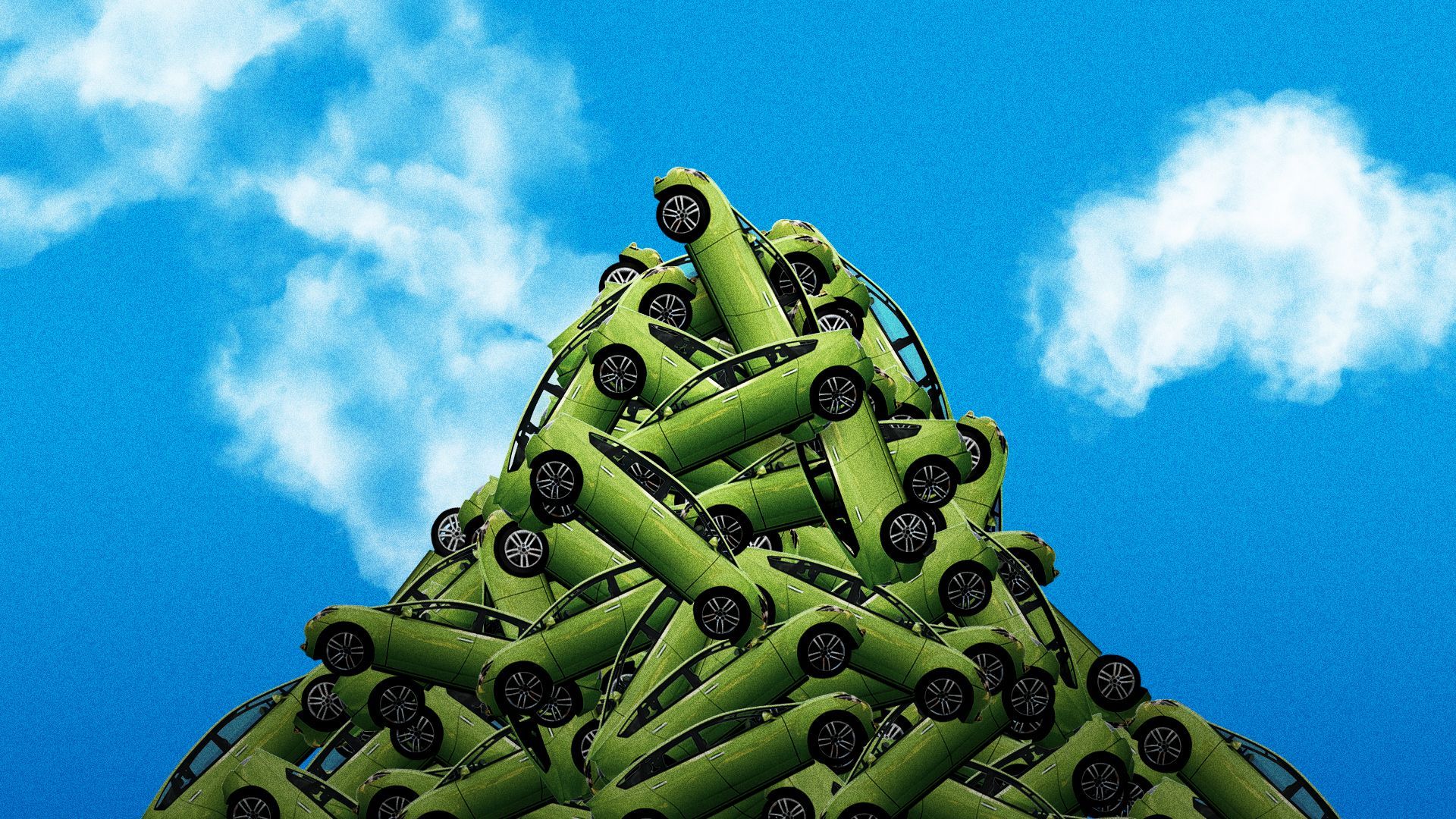

Unsold electric cars are piling up on dealer lots

- Joann Muller, author of Axios What's Next

Illustration: Maura Losch/Axios

The auto industry is beginning to crank out more electric vehicles (EVs) to challenge Tesla, but there's one big problem: not enough buyers.

自動車業界はテスラに対抗するために電気自動車(EV)を大量生産し始めているが、買い手が足りないという大きな問題が1つある。

Why it matters: The growing mismatch between EV supply and demand is a sign that even though consumers are showing more interest in EVs, they're still wary about purchasing one because of price or charging concerns.

重要な理由: EV の供給と需要の間のミスマッチが拡大していることは、消費者が EV にますます関心を示しているにもかかわらず、価格や充電に関する懸念から、EV の購入に依然として慎重であることを示しています。

- It's a "Field of Dreams" moment for automakers making big bets on electrification — they've built the cars, and now they're waiting for buyers to come, says Jonathan Gregory, senior manager of economic and industry insights at Cox Automotive.

コックス・オートモーティブ社の経済・産業洞察担当シニアマネージャー、ジョナサン・グレゴリー氏は、電動化に大きな賭けをしている自動車メーカーにとって、これは「夢の舞台」の瞬間だ。自動車メーカーはすでに車を作り、今は買い手が来るのを待っているところだ、と語る。

Driving the news: Cox Automotive experts highlighted the swelling EV inventories during a recent midyear industry review for journalists and industry stakeholders.

ニュースの推進:コックス・オートモーティブの専門家らは、ジャーナリストや業界関係者向けの最近の年央業界レビューで、EV在庫の膨張を強調した。

- EV sales, which account for about 6.5% of the U.S. auto market so far this year, are expected to surpass 1 million units for the first time in 2023, Cox forecasts.

- コックス氏は、今年これまでの米国自動車市場の約6.5%を占めるEV販売は、2023年には初めて100万台を超えると予想している。

- A Cox survey found that 51% of consumers are now considering either a new or used EV, up from 38% in 2021.

- コックスの調査によると、消費者の51%が現在、新品または中古EVの購入を検討しており、2021年の38%から増加している。

- Tesla’s rapid expansion, plus new EVs from other brands, are fueling the interest — 33 new models are arriving this year, and more than 50 new or updated models are coming in 2024, Cox estimates.

- テスラの急速な事業拡大に加え、他のブランドの新型EVが関心を高めている。今年は33の新型モデルが登場し、2024年には50以上の新型またはアップデートモデルが登場するとコックス氏は推定する。

Yes, but: Sales aren't keeping up with that increased output.

はい、しかし、その生産量の増加に売上が追いついていません。

Details: The nationwide supply of EVs in stock has swelled nearly 350% this year, to more than 92,000 units.

詳細: 今年の全米のEV在庫供給量は350%近く増加し、9万2000台以上となった。

- That's a 92-day supply — roughly three months' worth of EVs, and nearly twice the industry average.

- これは92日分の供給量に相当し、およそ3か月分のEVに相当し、業界平均のほぼ2倍に相当する。

- For comparison, dealers have a relatively low 54 days' worth of gasoline-powered vehicles in inventory as they rebound from pandemic-related supply chain interruptions.

- 比較のために言うと、パンデミック関連のサプライチェーン中断から回復しているため、ディーラーが保有するガソリン車の在庫は54日分と比較的少ない。

- In normal times, there's usually a 70-day supply.

- 通常、通常は 70 日分の供給があります。

- Notably, Cox's inventory data doesn't include Tesla, which sells direct to consumers.

- 注目すべきは、コックスの在庫データには、消費者に直接販売しているテスラが含まれていないことだ。

Zoom in: Some brands are seeing higher EV inventories than others.

- Genesis, the Korean luxury brand, sold only 18 of its nearly $82,000 Electrified G80 sedans in the 30 days leading up to June 29, and had 210 in stock nationwide — a 350-day supply, per Cox research.

- Other luxury models, like Audi's Q4 e-tron and Q8 e-tron and the GMC Hummer EV SUV, also have bloated inventories well above 100 days. All come with hefty price tags that make them ineligible for federal tax credits.

- Imported models like the Kia EV6, Hyundai Ioniq 5 and Nissan Ariya are also stacking up — likely because they're not eligible for tax credits either.

- Tesla's price-cutting strategy could be taking a toll, too: The once-hot Ford Mustang Mach-E now has a 117-day supply. Ford says that's the result of ramped-up production in anticipation of stronger third-quarter sales.

The intrigue: Hybrid vehicles have much lower inventory levels, supporting Toyota's argument that consumers want a stepping stone to fully electric cars.

- There's a relatively tight 44-day supply of hybrids industrywide, according to Cox.

- Toyotas are in particularly short supply — under 30 days each for Prius and RAV4 hybrids and plug-in hybrids.

Of note: Toyota's only fully electric model, the Bz4X, has a 101-day supply.

- While Toyota recently announced a 3-row electric SUV and new battery technology that could double the range of future EVs, it's sticking with a mix of hybrids, plug-in hybrids, and pure EVs for the foreseeable future.

What to watch: More charging infrastructure is coming, and EV prices should reach parity with gasoline vehicles around 2025, according to Bank of America Securities auto analyst John Murphy.

- Until then, automakers will be left waiting for EV buyers to show up.

Disclaimer: Cox Automotive's parent company, Cox Enterprises, also owns Axios.

0 件のコメント:

コメントを投稿